Navigating Title Loan Late Payments: Options & Rebuilding Strategies

A title loan late payment can lead to fees, penalties, and repossession. Open communication with len…….

In the intricate web of global finance, title loan late payments stand as a critical aspect that demands meticulous attention. This article delves into the multifaceted world of title loans, specifically exploring what constitutes a late payment, its implications, and the broader impact on individuals, businesses, and economies worldwide. By examining historical context, economic influences, technological advancements, regulatory frameworks, and real-world case studies, we aim to provide a comprehensive understanding of this dynamic financial phenomenon. Through this exploration, readers will gain insights into the complexities and potential solutions surrounding title loan late payments, shaping more informed decisions in a rapidly evolving financial landscape.

Definition: A title loan late payment refers to the failure to make a repayment on a title loan according to the agreed-upon terms within the specified grace period. These loans, secured against an individual’s vehicle title, offer quick access to cash but come with stringent deadlines for repayment. Late payments can be attributed to various factors, including financial hardships, unforeseen circumstances, or simply oversight.

Core Components:

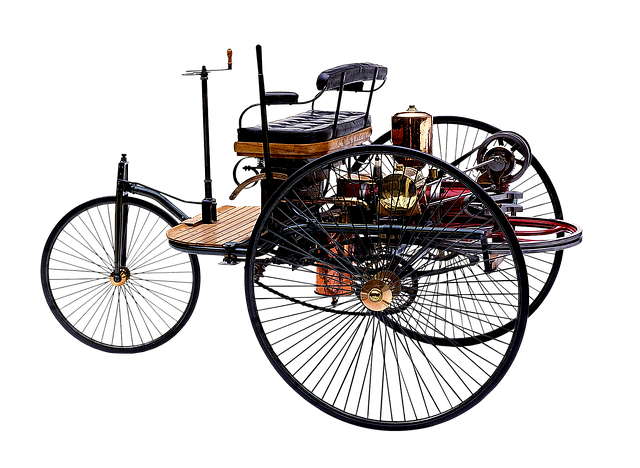

Historical Context: Title loans have a long history, dating back to the early 20th century when they emerged as a means for individuals to access immediate funds using their assets as collateral. Over time, these loans evolved with changing economic conditions and regulatory interventions. The late payment aspect has always been a critical factor, but its impact has varied based on regional financial landscapes and consumer protection laws.

Title loan late payments have left an indelible mark across diverse regions, reflecting both economic opportunities and challenges:

| Region | Impact & Trends |

|---|---|

| North America | Title loans are prevalent in the US and Canada, with robust online lending platforms. Late payment rates vary but have shown a rising trend due to the economic downturn and increasing loan volumes. |

| Europe | Strict consumer protection laws in many European countries limit title loan activity. However, digital financial services are expanding access, potentially increasing late payments in certain segments. |

| Asia Pacific | China and South Korea witness high demand for title loans due to their robust automotive industries. Late payment penalties are stringent, reflecting cultural norms of punctuality and contract adherence. |

| Emerging Markets | Rapid urbanization drives title loan adoption in countries like Brazil and India. Lack of traditional banking services attracts borrowers, but limited financial literacy may contribute to higher late rates. |

These trends underscore the global nature of title loans and the varying approaches to managing late payments, influenced by cultural, economic, and regulatory factors.

The economic landscape plays a pivotal role in shaping title loan late payment trends:

Technological innovations have revolutionized the title loan industry, impacting late payment dynamics:

Regulatory frameworks play a critical role in governing title loan practices and mitigating potential harm from late payments:

Despite its benefits, the title loan industry faces significant challenges and criticisms that impact late payment management:

Actionable Solutions:

Real-world examples offer valuable insights into effective title loan late payment management:

Case Study 1: Canada’s Secure Loan Program

In Canada, some lenders have implemented a unique program called “Secure Loan” that addresses late payment issues. Here’s how it works:

Case Study 2: Australia’s Digital Title Loan Platform

An Australian startup launched an online title loan platform with a focus on transparency and user-friendly features:

The title loan industry is poised for growth and transformation, driven by technological advancements and evolving consumer preferences:

Title loan late payments represent a complex interplay of economic factors, technological advancements, and regulatory frameworks. As this financial instrument continues to gain popularity worldwide, understanding its nuances becomes increasingly critical. By addressing challenges, embracing technological innovations, and advocating for robust consumer protection, the title loan industry can foster access to credit while ensuring borrowers’ financial well-being.

The case studies presented illustrate successful strategies that balance the benefits of title loans with responsible lending practices, highlighting the importance of adaptability and empathy in this dynamic sector. As we look ahead, the future of title loans appears poised for digital transformation, personalization, and a renewed focus on sustainability, shaping a more inclusive and responsible financial landscape.

Q: What happens if I miss a title loan payment?

A: Missing a payment typically triggers a late fee, and the lender may contact you to discuss repayment options. Failure to respond may lead to additional fees, potential repossession, or even legal action.

Q: Can I refinance my title loan to avoid late payments?

A: Refinancing is an option, but it depends on your current loan balance, interest rates, and lender policies. Be cautious, as refinancing could extend the loan term, potentially increasing overall interest paid.

Q: How do I choose a reputable title loan provider?

A: Research lenders thoroughly by checking their online reviews, licensing, and customer service reputation. Compare loan terms, fees, and interest rates to ensure you’re getting a fair deal.

Q: Are there any legal protections for borrowers in case of title loan default?

A: Yes, borrower rights vary by region. Many jurisdictions have laws protecting borrowers from unfair collection practices, repossession procedures, and excessive fees. Familiarize yourself with these laws to understand your rights.

Q: Can technology completely eliminate title loan late payments?

A: While technology can enhance transparency and convenience, it doesn’t guarantee elimination. Late payments may still occur due to unforeseen circumstances or borrower oversight. However, tech solutions can provide timely reminders and improve overall repayment discipline.

A title loan late payment can lead to fees, penalties, and repossession. Open communication with len…….

Title loan late payment grace periods offer borrowers a safety net for temporary financial setbacks,…….

Title loan late payments severely harm credit scores due to the secured nature of these loans linked…….

Title loan late payments require proactive communication with lenders who often offer extensions or…….

Missing title loan payments can lead to severe consequences, including credit damage, additional fee…….

Late Title Loan payments can lead to financial strain, including fees, legal issues, and repossessio…….

Understanding title loan late payment fees is crucial to avoid financial stress. Lenders charge perc…….

Title loan late payments can trigger severe penalties like higher interest rates, fees, and reposses…….

Title loan late payments create a cycle of debt and stress for borrowers. Solutions include flexible…….

Title loan late payments can lead to high fees, interest charges, and vehicle repossession, worsenin…….