Missing a title loan payment can lead to serious consequences like fees, repossession, and credit score damage. To avoid these issues, understand your contract terms (like inspections), communicate promptly with lenders in San Antonio about potential solutions, budget effectively, build an emergency fund, and explore better financial options like semi truck loans for more favorable terms.

A late payment on a title loan can have significant financial repercussions, but understanding and taking proactive steps can help you recover and secure your future. This article guides you through the process of recovering from a title loan late payment, offering insights into the immediate impact and long-term strategies. We’ll explore practical steps to get back on track, focusing specifically on title loan scenarios, while also providing preventive measures to ensure financial stability moving forward.

- Understanding the Impact of a Late Payment

- Steps to Recover from a Title Loan Late Payment

- Preventive Measures for Future Financial Security

Understanding the Impact of a Late Payment

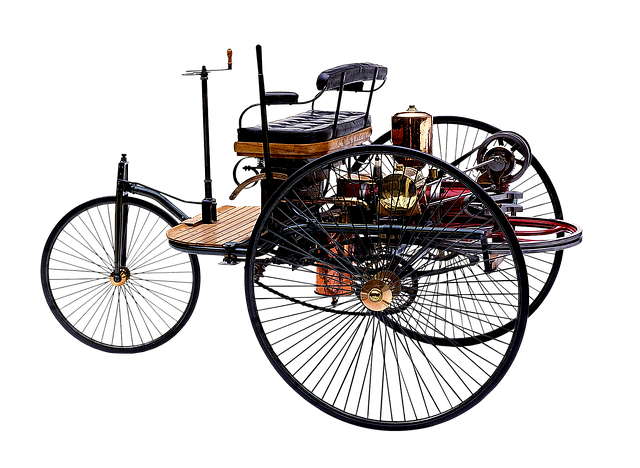

When you miss a payment on a title loan, the impact can be significant and far-reaching. Lenders often charge late fees, which can add up quickly, further straining your finances. More importantly, continued non-payment can lead to repossession of the secured asset, in this case, your vehicle. This not only ends your access to transportation but also has long-term financial implications, affecting your credit score and making it harder to secure future loans.

A late payment on a title loan serves as a stark reminder that neglecting financial obligations can have severe consequences. It’s a wake-up call to reassess budgeting, explore options for extra income, and create a plan to meet loan requirements moving forward. A crucial step is to understand the specific Loan Requirements and Terms of your title pawn agreement to avoid similar situations in the future. This may involve scheduling regular vehicle inspections to ensure its condition remains satisfactory, as some lenders require this as part of maintaining the security of the loan.

Steps to Recover from a Title Loan Late Payment

Recovering from a late payment on a title loan can be challenging but is manageable with a strategic approach. The first step is to understand the consequences of your actions and communicate openly with your lender. Late fees, interest charges, and potential repossession are common repercussions, so contacting your lender immediately to discuss options is crucial. Many lenders in cities like San Antonio Loans offer various solutions, including short-term repayment plans or loan refinancing, tailored to help borrowers overcome temporary financial setbacks.

Assess your current financial situation and create a budget to avoid future delinquencies. You can negotiate with the lender for extended terms if feasible, which provides more time to repay without additional fees. Alternatively, exploring options like vehicle equity loans could be an option, where you use the value of your car as collateral for a new loan, offering lower interest rates and more flexible repayment terms. Remember, proactive communication and financial planning are key to recovering from a title loan late payment.

Preventive Measures for Future Financial Security

To prevent future financial setbacks like a late payment on a title loan, it’s crucial to establish robust financial habits from the start. One key measure is maintaining a strict budget and tracking expenses meticulously. Understanding your monthly cash flow and allocating funds for essentials, savings, and debt repayment ensures you never find yourself short on funds again. Additionally, building an emergency fund to cover unexpected costs can serve as a safety net, preventing late payments due to unforeseen circumstances.

Considering options for stable and long-term financial solutions like semi truck loans or other forms of credit with lower interest rates can be wise. Regularly reviewing your loan approval process and comparing rates will help you make informed choices. By taking these proactive steps, individuals can enhance their financial security and avoid the stress associated with late payments, fostering a more secure financial future.

A title loan late payment can have significant financial repercussions, but understanding the impact and taking proactive steps can help you recover and secure your financial future. By promptly addressing the situation through communication with lenders, exploring options like payment plans or loan modifications, and implementing preventive measures such as budgeting and building an emergency fund, you can mitigate the effects of a late payment. Remember, being proactive is key to avoiding future financial strain and maintaining long-term stability.