Title loan late payments can significantly harm borrowers, leading to fees, asset repossession, and damaged credit. To avoid these consequences, proactive measures like budget creation, regular updates, exploring loan extensions or refinancing, and preventative vehicle maintenance are crucial. These strategies ensure timely repayments and provide options for managing financial strain without additional charges.

Title loans, often seen as a quick cash solution, come with unique challenges. One of the primary concerns is the potential for late payments, which can have significant consequences. This article breaks down the basics of title loan late payments, exploring their causes and effects. We also offer practical strategies to help borrowers avoid and manage these delays, ensuring a more favorable repayment experience. By understanding these dynamics, you’ll be better equipped to navigate the complexities of title loans.

- Understanding Title Loan Late Payments: The Basics

- Consequences of Delayed Repayments

- Strategies to Avoid and Manage Late Payments

Understanding Title Loan Late Payments: The Basics

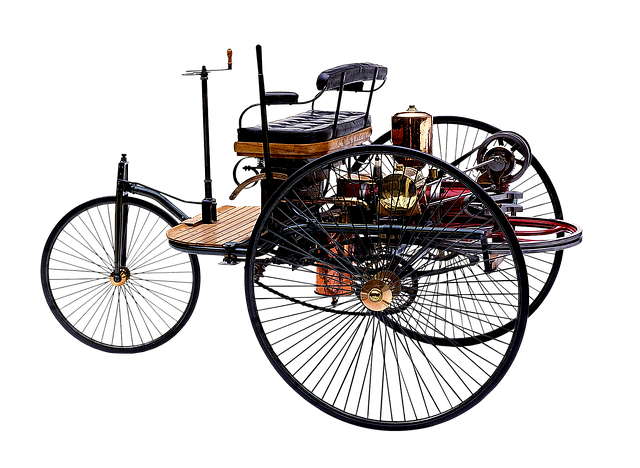

When it comes to Title Loan Late Payments, understanding the basics is crucial for borrowers. A title loan, secured by the title of your vehicle, offers quick access to cash. However, if you fail to make payments on time, consequences can arise. Lenders typically give a grace period before initiating collection processes or assessing penalties.

These late payments can impact your ability to repay the loan, leading to various outcomes. You may be eligible for Loan Refinancing options to adjust your repayment terms or explore different Repayment Options based on your financial situation. Remember, timely payments are essential to avoid fees and maintain a good credit standing.

Consequences of Delayed Repayments

When it comes to Title Loan late payments, the consequences can be severe. Each day that a repayment is delayed increases the financial burden, as interest and fees accumulate. Lenders typically have grace periods, but exceeding this window can lead to repossession of the secured asset, such as a vehicle, in Fort Worth Loans cases. This not only stops further use of the asset but also impacts one’s credit score, making future loan applications more challenging.

For those dealing with Title Loan late payments, considering options like loan refinancing could be beneficial. Semi Truck Loans providers often offer flexible terms and lower interest rates to help borrowers manage their debt. However, it’s crucial to evaluate all available alternatives and understand the terms before making any decisions to avoid further financial strain.

Strategies to Avoid and Manage Late Payments

Late payments on a title loan can lead to significant consequences, so it’s vital to employ strategies that ensure timely repayments. One effective approach is to create a detailed budget that accounts for all expenses and income sources. This way, borrowers can allocate funds wisely and avoid overspending, which often leads to late payments. Regularly reviewing and adjusting the budget to fit changing financial circumstances is key.

Additionally, considering a financial solution like an online application for a loan extension or refinancing could provide much-needed relief. Some lenders offer flexible options for making up missed payments without incurring extra fees. A vehicle inspection might also be beneficial; ensuring your car remains in good condition can prevent unexpected breakdowns that could delay repayments.

Title loan late payments can significantly impact your financial situation, but with the right strategies, you can effectively manage them. By understanding the basics of these payments and their consequences, and by employing avoidance and management tactics, individuals can navigate this challenging aspect of title loans more confidently. Remember, proactive measures can help prevent delays, ensuring a smoother borrowing experience.